japan corporate tax rate kpmg

Taxation in Japan 2020. Donation made to designated public purpose companies.

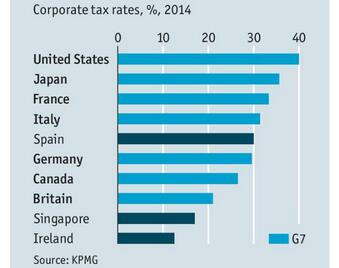

German Rios On Twitter Corporate Tax Rates In G7 Countries Spain Ireland Singapore Http T Co Ggqyyb9h6w Twitter

Corporate - Group taxation.

. The contents reflect the information available up to. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by. The worlds highest corporate tax rate belongs to the United Arab Emirates UAE with a tax rate of up to 55 in 2019 according to KPMG.

2021 Global Withholding Taxes. Before 1 October 2019 the national local corporate tax rate was 44. KPMG Tax Corporation either through your normal contact at the firm or using the contact details shown below.

The articles of the Corporate Tax Law CTL and CTL Enforcement Ordinance CTLEO were revised to agree with the updated Article 5 of the OECD MTC. Some countries also have lower rates of corporation tax for smaller companies. Share with your friends.

Principal international tax kpmg us. This paper explores how corporate income tax reform can help Japan increase investment and boost potential growth. This booklet is intended to provide a general overview of the taxation system in Japan.

Last reviewed - 02 March 2022. KPMGs corporate tax table provides a view of corporate tax rates around the world. Regular business tax rates currently apply and vary between 09 percent and 228 percent depending on the tax base taxable income and the location of the taxpayer.

025 of capital plus capital surplus 25 of income x 14. Donations and the corporate income tax rates are the same for both a branch and a Japanese company. However a branch and a.

Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. 81 3 6229 8000 Fax. 81 3 6229 8000 fax.

Taxation in Japan Preface. 81 6 4708 5150 Fax. 81 3 5575 0766.

National local corporate tax. In general larger and more industrialized countries tend to have higher corporate tax rates than smaller countries. Tax Rate Applicable to fiscal years.

Historical corporate tax rate data. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. As with dividend income the WHT national tax is subject to the income surtax of 21 which is levied for the income earned for the period from 1 January 2013 through 31 December 2037.

This booklet is intended to provide a general overview of the taxation system in Japan. Special local corporate tax rate is 1526 percent which is imposed on taxable income multiplied by the standard of regular business tax rate. Object Moved This document may be found here.

Beginning from 1 October 2019 corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 103 of their corporate tax liabilities. 81 3 5575 0766. The G7 which is made up of.

Company size and income Corporate tax rates table - KPMG Global - KPMG InternationalKPMGs corporate tax table provides a view of corporate tax rates around the world. 81 3 6229 8000 Fax. Using international and Japan-specific empirical estimates of corporate tax elasticities investment is predicted to expand by.

Standard enterprise tax and local corporate special tax. 34 Venezuela 34 France 31 and Japan 3062. Corporate and international tax proposals in tax reform package 19 December 2018.

Taxation in Japan 2019. The effective corporate tax rate using Tokyo tax rates applied to a company whose stated capital is over JPY100 million is currently 3564 percent and the future tax rates will be. KPMG Tax Corporation Izumi Garden Tower 1-6-1 Roppongi Minato-ku Tokyo 106-6012 Japan Tel.

KPMG Tax Corporation either through your normal contact at the firm or using the contact details shown below. Data is also available for. 15 15 Taxable Income.

The WHT for interest is applicable at a rate of 15 national tax and 5 local tax and a tax credit may be available for such WHT. Contact KPMGs Federal Tax Legislative and Regulatory Services Group at 1 2025334366 1801 K Street NW Washington. 0375 of capital plus capital surplus 625 of income x 12.

Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced with a new regime of group relief group tax relief. Japan 3062 3062 3062 3086 3086 3086 3386 3564 3801 3801 4069. KPMGs corporate tax rates table provides a view of corporate tax rates around the world.

The new regime will be effective for tax years beginning on or after 1 April 2022. The revised definition of PE will apply to the tax years beginning on or after 1 January 2019. Changes to the controlled foreign corporation CFC regime considering the corporate tax rate reduction in the United States.

81 3 5575 0766 E-mail. KPMG Tax Corporation Izumi Garden Tower 1-6-1 Roppongi Minato-ku Tokyo 106-6012 Japan Tel. While the information contained in this booklet may assist in gaining a better understanding of the tax system in Japan it is recommended that specific advice be taken as to the tax implications of any proposed or actual transactions.

Data is also available for. While the information contained in this booklet may assist in gaining a better understanding of the tax system in Japan it is recommended that specific advice be taken as to the tax. After the amendment the types of taxable presence that a foreign corporation may have in Japan include.

Principal International Tax KPMG US. Indirect tax rates individual income tax rates. Note that the definition of capital surplus was amended by the 2020 Tax Reform Act from the tax law purpose to.

81 6 4706 3881 Dainagoya Building 26F 3-28-12 Meieki Nakamura-ku. This page provides - Japan Corporate Tax Rate - actual values historical data forecast chart statistics economic. Japan corporate tax rate kpmg.

The corporation tax is imposed on taxable income of a company at the following tax rates. Summary of worldwide taxation of income and gains derived from listed securities from 123 markets as of December 31 2021.

Minimum Global Corporate Tax Rate Gains Support Kpmg Canada

Outline Of The 2022 Tax Reform Proposals Kpmg Japan

Presented By Ayesha Macpherson Tax Partner Kpmg Hong Kong Making The Best Tax Decisions For Your China Business Ventures March Ppt Download

Jp Extended Tax Filing And Payment Deadlines Kpmg Global

2022 Tax Reform Passage Of The Bills Kpmg Japan

Japan Highest Tax Rate 2021 Statista

Ceo Outlook Pulse Survey Insights For Tax Leaders Kpmg Global

Minimum Global Corporate Tax Rate Gains Support Kpmg Canada

Ie Singapore Iadvisory Seminar Doing Business In Japan General Overview Of Taxation In Japan Pdf Free Download

New York State Tax Provisions In Enacted Budget Bills Kpmg United States

Presented By Ayesha Macpherson Tax Partner Kpmg Hong Kong Making The Best Tax Decisions For Your China Business Ventures March Ppt Download

Ie Singapore Iadvisory Seminar Doing Business In Japan General Overview Of Taxation In Japan Pdf Free Download

Jp Extended Tax Filing And Payment Deadlines Kpmg Global

Outline Of The 2021 Tax Reform Proposals Kpmg Japan

World S Highest Effective Personal Tax Rates

World S Highest Effective Personal Tax Rates

Ie Singapore Iadvisory Seminar Doing Business In Japan General Overview Of Taxation In Japan Pdf Free Download